A note payable is a promise in writing to pay a specific amount of money by a specific future date. Like accounts payable, notes payable are recorded as liabilities. Our creditor (liability) exists currently in our records at $200 on the credit side (right).

- Typically, you record depreciation at the end of the year to show how much value the long-term assets have lost during the year.

- However, if any costs are incurred as a refundable deposit, it will qualify as an asset.

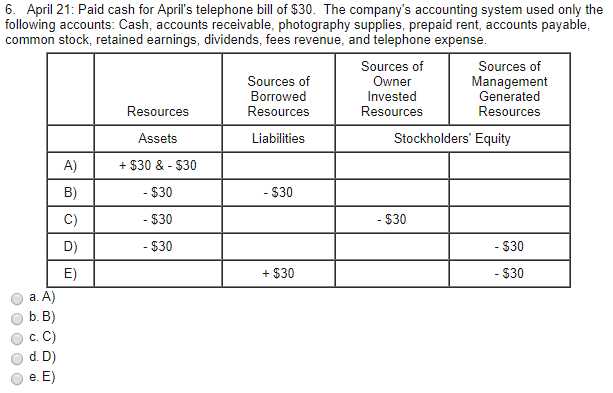

- The journal entry for the telephone bill is that the telephone bill is debited and the cash is credited.

Examples for How to Journalize Paying a Bill in Accounting

Paid Cash for Telephone bill is to record an expense transaction with payments happening in physical currency. When you receive a phone bill and you haven’t paid for it then you should add that under Current liabilities. In our example we are adding 150 under Current liabilities – Trade and other payables. We have just received a phone bill for 150 at the start of the month. Usually they are not paid right away, but on the due date of the payment.

What is your current financial priority?

They have to comply with accrue accounting rule which requires the revenue and expense to be recorded base on usage, not the cash paid. If that’s the case, you still need to record the expense when it was incurred on Jan. 20, but you’ll use the accounts payable account for the credit. Generally, you incur expenses when you submit the order or are billed by the vendor. Assets increase on the debit side (left) and decrease on the credit side (right). The telephone bill is an expense – it is an event or something of value delivered that results in money flowing out of the business, either immediately or at a later date.

Journal Entry and Ledger Posting for Telephone Expenses paid through Bank Account

But you don’t always pay for your expenses on the same day they are incurred. By maintaining records of your expenses, you can better understand the cost of running your business and calculate your profits. Per Personal Account Golden Rules of Accounting, Debit the Receiver and Credit the Giver. Therefore, the Liability account will be credited in the journal entry and let’s see the Journal entry. We need to identify the other GL accounts which are affected due to this journal entry. Accrued expense refers to an expense that the company has not paid yet but it has already incurred.

Is the telephone an asset or expense?

For example, the first accounting entry to record an electricity expense is made not when an electricity bill is received, but when it is paid. If you’ve paid for the expense, you’ll credit your cash account, and if you still owe the money, you’ll credit accounts paid telephone bill journal entry payable or accrued expenses. The telephone charges a/c is debited and the respective cash or bank a/c is credited. A company incurs several expenses arising from its operating activities. For example, rent, rates, taxes, telephone bills, electricity bills, etc.

There are several types of expenses you can incur as a result of owning and operating a business. Keeping track of the money that leaves your business may not be as fun as counting the revenue you bring in through sales. But understanding how much you spend is just as important as knowing how much money you make. Let’s discuss how to pass Journal Entry and post them into their respective Ledger Account, when Telephone Expenses are paid through Bank Account. Let’s discuss how to pass Journal Entry and post them into their respective Ledger Account, when Telephone Expenses are paid by Cash. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Now, we got a concrete understanding of the nature of this account balance. So, we can try to resolve all the basic questions like the type of Account, applicable accounting rules, and different considerations before recording the journal entry. A company records an increase in this liability each period as the amount of accrued interest increases. Even though the December bill has not been recorded in the books, the fact is that the service has been received, and hence expenses incurred. The phone service charge will be recorded as the expense in the customer income statement.

For simplicity’s sake, also assume that the firm began operations on Monday 2 January 2017. The first payday of the year was Friday 6 January 2017 and the weekly salaries total $1,500. For example, suppose that a firm pays its salaries every Friday for the workweek ending on that day. Since liabilities increase on the credit side (right) and decrease on the debit side (left), we’re going to debit this. The easiest part of this transaction to work out is the cash component.

It means that the customer will use the service and pay in the following month. It is opposite from the prepaid phone that customers top up the phone and use later. Therefore, the net Entry will knock off the Liability account, telephone expenses will be on the debit side, and Bank Accounts will be on the credit side. This is because 1) more expenses mean 2) less profit and 3) less for the owner. The external parties’ stake in the assets of the business (i.e. liabilities) has increased by $200 to $5,200 as a result of this telephone bill that is owing. Adjusting entries must be made for these items in order to recognize the expense in the period in which it is incurred, even though the cash will not be paid until the following period.

The journal entry is debiting telephone expense and credit accrued payable. When the company makes payment to the phone service provider, they simply reverse the account payable and decrease cash. There are two approaches for recording the Paid telephone charges journal entry. So, the Entry will be debiting the telephone expenses and crediting the bank account. When ABC make payment to supplier, they will reduce cash and accounts payable.

Let’s say that you paid for six months of office rent upfront in January. The amount that was prepaid (rent for February through June) gets recorded as an asset in a prepaid rent account. The timeline below shows the total amount of salaries expense for the week ended Friday, 4 January 2018. It also indicates how much expense should be allocated between the two years.