When shares are repurchased, the treasury stock account is debited to decrease total shareholders’ equity. If the treasury stock is resold later, the cash account is increased through a debit while the treasury stock account is decreased. This increases total shareholders’ equity through a credit notation on the balance sheet. For resales, under the cash method of accounting for treasury stock, the company takes any gains or losses on the resale to the additional paid-in capital account. In case of a loss, if the additional paid-in capital account balance is below the loss made on the resale, any additional amount is set off against the retained earnings account. The treasury stock par value method is an alternate method to account for treasury stock.

Does APIC only record the additional paid-in capital from shareholders?

To the average investor, the par value of a bond is quite relevant, while the par value of a stock is something of an anachronism. If the amounts or circumstances are material, then it is unlikely that account titles will convey all the information that tax deductible expenses for photographers the statement user needs. In comparison to our starting point, the basic EPS of $2.00, and the diluted EPS is $0.10 less. Each tranche has a strike price, which the option holder must pay to exercise the option as part of the contractual agreement.

Par Value, Market Value, and Stockholder Equity

If a company has purchased treasury shares at a total cost of $25 per share, then sells those shares for $24, this transaction would cause an increase in Revenues and a decrease in Cash. When treasury stock is resold above its cost, Cash is debited for the entire proceeds. Treasury stock is not considered an asset; it is a reduction in stockholders’ equity. In computing earnings per share (EPS), treasury stock is not considered outstanding and must be deducted when determining the weighted average number of shares outstanding. Stock can be issued in exchange for cash, property, or servicesprovided to the corporation. For example, an investor could give adelivery truck in exchange for a company’s stock.

Which of these is most important for your financial advisor to have?

For no-par stock with a stated value, the entries for the purchase and sale of treasury shares are the same as those described above. With the exception of the possible impact on the amount of legal capital, these shares are in substance the same as unissued shares and should generally be accounted for under that assumption. The shares of treasury stock are held by the issuing corporation, which cannot exercise any of the rights of ownership apart from the right to sell them. Stockholders’ equity is often referred to as the book value of a company. A company’s stockholders’ equity is recorded on its balance sheet, and the values signify the par value of the stock. Because shares of stocks will frequently have a par value near zero, the market value is nearly always higher than par.

- Stockholders’ equity includes paid-in capital, retained, par value of common stock, and par value of preferred stock.

- To the average investor, the par value of a bond is quite relevant, while the par value of a stock is something of an anachronism.

- All of our content is based on objective analysis, and the opinions are our own.

- When management does not intend to reissue shares but also does not desire to formally retire them, it is recommended that the par value method be applied.

Example of the Cost Method

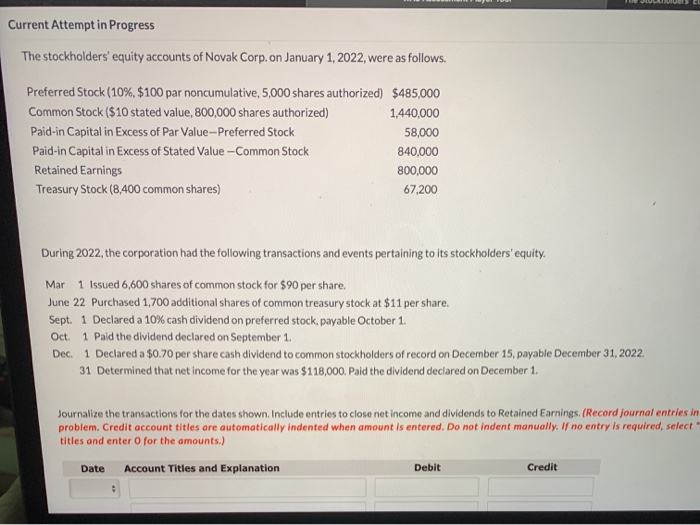

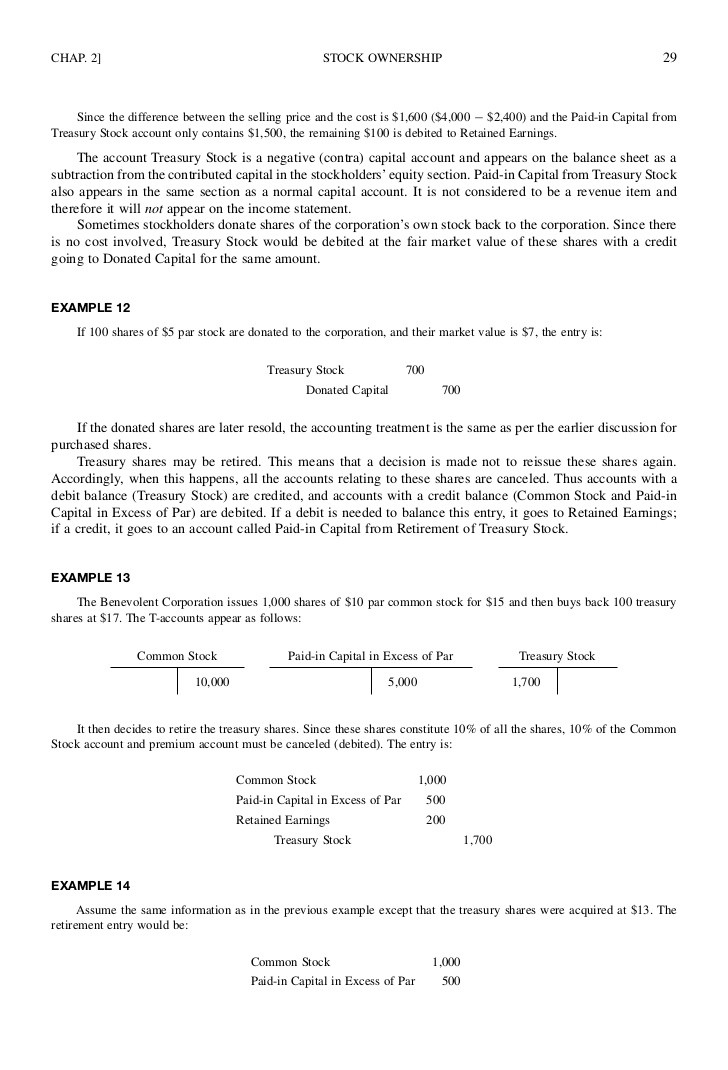

There are two methods possible to account for treasury stock—the cost method, which is discussed here, and the par value method, which is a more advanced accounting topic. The cost method is so named because the amount in the Treasury Stock account at any point in time represents the number of shares held in treasury times the original cost paid to acquire each treasury share. The difference between the cost and par value method of accounting for treasury stock is in their treatment of reacquisitions and resales differently. Under the cost method of accounting for treasury stock, the company records the full payment made for the repurchase of shares in the treasury stock account.

That avoids any potential legal liability if the stock drops below its par value. Most individual investors buy bonds because they represent a safe haven investment. The yield is paid in regular installments, providing income until the bond matures. The reason is that the denominator (the share count) has increased, whereas its numerator (net income) remains constant.

When a company purchases treasury stock, it is reflected on thebalance sheet in a contra equity account. As a contra equityaccount, Treasury Stock has a debit balance, rather than the normalcredit balances of other equity accounts. In substance, treasury stockimplies that a company owns shares of itself.

The cost method is so named because the amount in theTreasury Stock account at any point in time represents the numberof shares held in treasury times the original cost paid to acquireeach treasury share. When a company purchases treasury stock, it is reflected on the balance sheet in a contra equity account. As a contra equity account, Treasury Stock has a debit balance, rather than the normal credit balances of other equity accounts. In substance, treasury stock implies that a company owns shares of itself. Treasury shares do not carry the basic common shareholder rights because they are not outstanding. Dividends are not paid on treasury shares, they provide no voting rights, and they do not receive a share of assets upon liquidation of the company.

Because shares held in treasury arenot outstanding, each treasury stock transaction will impact thenumber of shares outstanding. When stock is repurchased for retirement, the stock must beremoved from the accounts so that it is not reported on the balancesheet. The balance sheet will appear as if the stock was neverissued in the first place.